Get clarity on your areas of opportunity, risk, and relief.

A small, one-time investment can give you the answers you’ve been looking for to take your company to the next level of profitability and performance quickly and for the long-haul.

We have three Diagnostic Services specific to the insights and improvement you need now.

Accounting Wellness Assessment

You can’t make Good Decisions with Bad Numbers

Just as you benefit from a yearly physical exam by your doctor, your accounting people and processes can benefit from a periodic checkup to determine their health. That’s why New Life CFO has created our Accounting Wellness Assessment service. This assessment covers 6 key areas of your accounting:

1. Health of your accounting functions and departments

New Life assesses the health of your accounting functions and departments. While this is not an audit or attestation service, it is a way to document where your accounting department is strong and where your accounting department needs improvement. We are there to help guide and mentor staff, not to replace them.

2. Understanding your accounting department functions and performance

We will begin by talking to your staff to fully understand what their role is in the department. We will review policies and procedures to ensure that employees are adhering to documented policies and procedures, but also look for room for streamlining processes and to improve processes.

3. How it is being implemented in action

We start by reviewing your close calendar. A close calendar is a listing of what is to be accomplished on a monthly basis to keep the books clean and up-to-date, along with who is responsible for that task.

4. Balance sheet reconciliation

Every balance sheet account should be formally reconciled monthly and documented so that it is frozen in time. This way, if someone posts something after close and changes a period, you will know what it was.

Our review will entail looking at the reconciliations and ensuring that we are not carrying old, outdated information as a balance sheet item when it should have been moved to the income statement long ago.

5. Variance analysis

When we know that the balance sheet is clean, we can turn to variance analysis. This helps identify miscodes and, also, identify and document fluctuations so that each month is supported. This way, if you are looking at a trailing 12-month income statement and notice that one account doubled halfway through the year, you can go back and see why.

6. Reporting

Recommendations for training of personnel, segregation of duties, internal control, streamline processes, and for a close calendar, balance sheet reconciliation package, and variance analysis if needed.

We will meet with the leadership team to discuss our findings and once implemented, we will follow up with your staff to ensure that everyone is set up for success!

We are here to help your accounting get well and provide you with the numbers you need to make good decisions. Give us a shout and let us know your symptoms so we can diagnose and prescribe what you need.

Insight 2911

“For I know the plans that I have for you”, says the Lord, “plans to prosper you and not to harm you, plans to give you hope and a future.” – Jeremiah 29:11 NIV

Your financials are nothing more than a historical reflection of your people, their decisions and behaviors, and your processes and systems. Therefore, if you don’t like your results, you MUST change those factors. A CFO’s job is to identify and prioritize these changes to ensure alignment with strategy and drive ROI while minimizing risk.

Our Insight 2911 diagnostic assessment identifies these changes, quantifies the impact and prioritizes the various initiatives to drive your performance. Insight 2911 is a multi-year, comprehensive financial deep dive into your financials combined with operational data and industry benchmarks. It is designed to map out the pathway to radically improve EBITDA, Cashflow, Liquidity and Consistent performance of the company over the next 3-, 6-, 9- and 12-month periods.

The outcomes highlight Risks, Threats and Opportunities for your business and the financial impact of addressing these with heavy emphasis on driving Cash Flow, Liquidity and EBITDA ASAP. This serves as the foundation for building and executing a plan to fulfill your true organizational potential.

Whether you are looking to take your company from solid performance to Best In Class, restore the company to consistent profitability and financial health, or prepare the company to raise capital, Insight 2911 is designed to connect the dots to that future vision.

At New Life CFO, we believe your financials, metrics and KPIs should work together to create an appropriate level of anxiety for your team to take action. Our deliverables will include a tailored Dashboard with a suite of recommended Metrics and KPIs, each with Targeted Performance, so you can readily monitor your progress and keep your team focused and on track to deliver the defined results.

Let us provide the insights, metrics and KPIs to help your business prosper.

Freedom 2521 – Turning Sweat Equity into Gold

“…you have been faithful with a few things; I will put you in charge of many things.” – Matthew 25:21

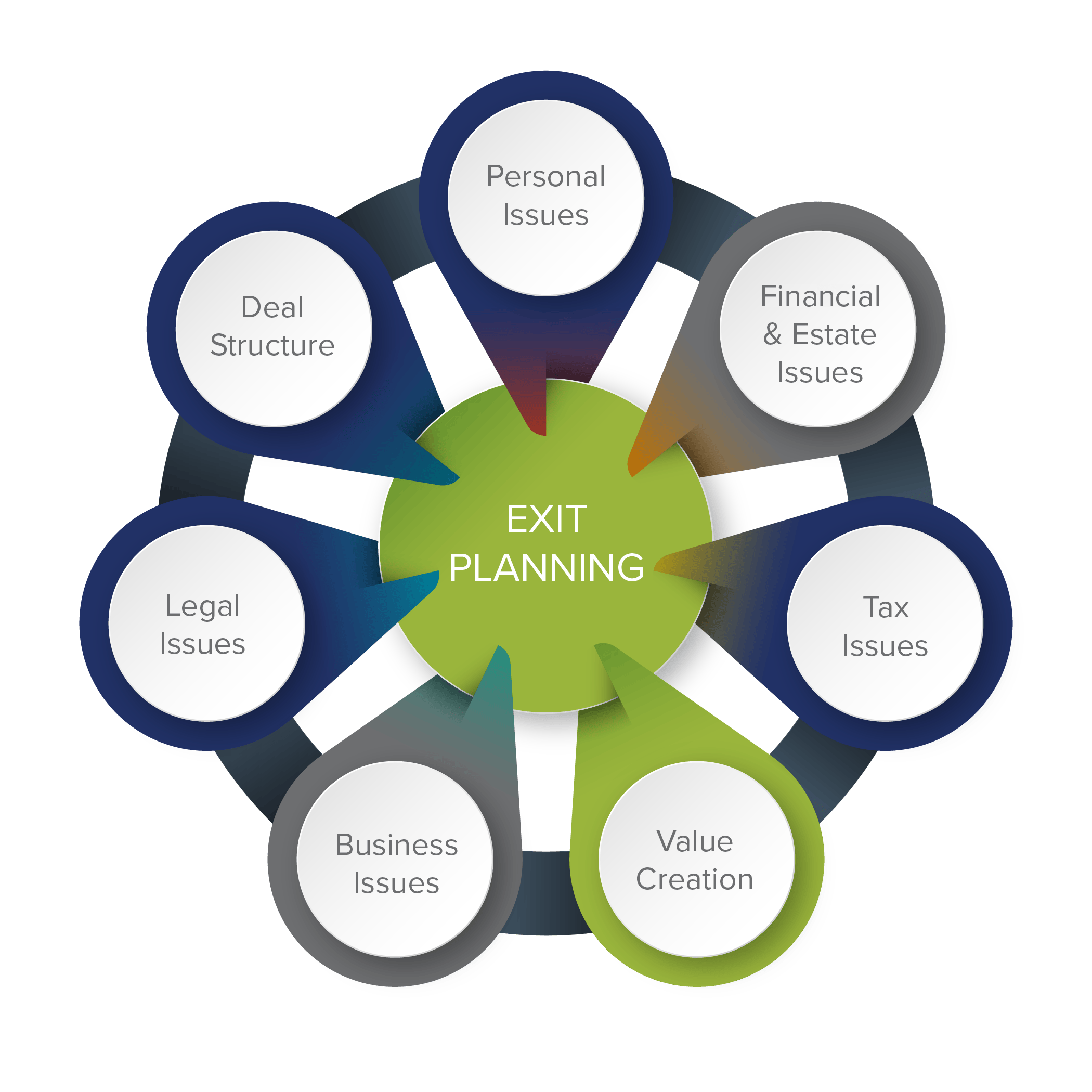

Our Freedom 2521 Turning Sweat Equity into Gold service is all about building company value. Whether you are thinking about transitioning your company to other family members or employees or exploring selling your company to an external buyer, exit planning is essential to ensure you receive the greatest value of the sweat you have poured into your business over the years.

Exit planning is broader than just value creation. It encompasses tax issues, financial and estate issues as well as personal. This is in addition to the everyday issues such as tax, legal, etc.

Exit planning doesn’t happen overnight. It’s typically an 18-36 month process depending on where your personal and business situations currently stand.

Did you know, though, that:

- 83% of businesses who want to sell DO NOT get to a deal that closes

- Only 17% successfully sell or transition to someone else

- 72% of business owners DO NOT HAVE an Exit plan

- 75% of owners “profoundly regret” the decision or deal after only 12 months

- Only 29% of business survive INTO the 2nd generation (8% to 3rd

Why is that?

- Common indicators that your company’s value may be less than you think include:

- Volatile Gross Margin %

- Volatile EBITDA

- Good Months and Bad Months

- Below Industry Average EBITDA

- Staff Turnover

- Cash Crisis

- Banker Problems

- Customer concentration

These are all things that any prospective buyer will investigate during due diligence. We can help you ensure these things are rectified before you get there.

And not to depress you, but you need to know the dynamics of the market for businesses selling in the next 5-10 years. We call it the “gray tsunami”. Why?

- Baby Boomers Run 12mm businesses

- Boomers own 2/3 of businesses with employees

- 83% are expected to change hands in the next 5-10 years

- Estimated value of these businesses approaches $14 TRILLION Dollars

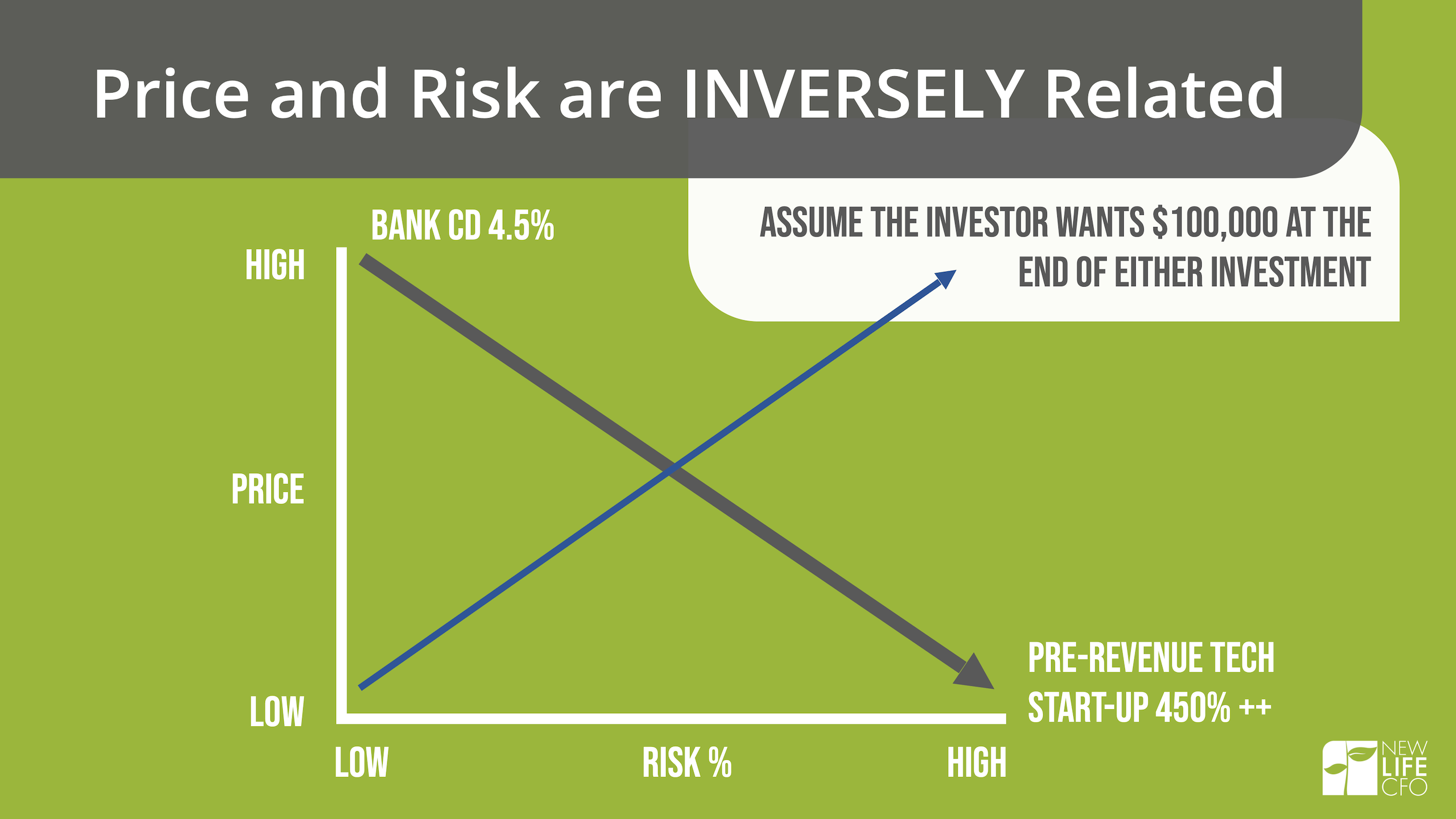

Our Freedom 2521 service is designed to accelerate the value of your business. This includes determining the delta between the ”As Is” Value and the “Should Be” Value, building the plan with risks and foundation first, and relentlessly executing the plan. It also takes into account what you need your business valuation to be in order to fund what you want to do next after you exit your company.

Our goal is to help you accelerate growth (i.e. new products to existing customers, existing products to new customers), create consistent execution through processes that are repeatable, trainable and sustainable, and to create a business that is scalable into new markets.

Let us help you turn your sweat equity into gold

I cannot say enough about our experience with Burt Copeland and his organization. His character and aptitude for understanding business needs and opportunities impressed our entire team.

When Burt came on staff he identified our top priorities and created buy-in among our owners and leadership team.

We are 21 months in and there is no one on the Exec team that could imagine us functioning without New Life CFO.

— Kari Pickering, Chief Operating Officer, iClassPro